15+ Subsidized loan

There are also limits to eligibility windows for Direct Subsidized loans unlike for Direct Unsubsidized loans. Federal Direct Subsidized Loan from Federal Direct Subsidized Loan.

2

Compare the Top Student Loan Providers.

. The US Federal department pays the interest for the student loan taken by a student. Subsidized loans are based on financial need. Get Instantly Matched with the Ideal Student Loan Options For You.

A subsidized loan officially known as a direct subsidized loan is a type of federal student loan available to undergrads who demonstrate financial need. Subsidized and Unsubsidized Aggregate Loan Limit. Subsidized loans are designed to help undergraduate students with financial need which is determined by the students Free Application for Federal Student.

Affiliate Disclosure and Integrity Pledge. The current rate for undergraduate borrowers who take out a subsidized student loan is 499. Ad Help Cover College Costs and Get a Student Loan Without the Fees.

10 or 15 year repayment terms available. Citizens Offers Competitive Rates Multiple Loan Options That Fit Your Needs. Apply Today to Lock in Low Rates.

Customize Your Student Loan With Rate And Repayment Options. 57500 for undergraduate students -- No more than. Subsidized Loan Time Limitation.

Quick and Easy Application. Ad Help Cover College Costs and Get a Student Loan Without the Fees. Ad Nelnet Bank is supported by a company with 40 years of student loan expertise.

During your first year you. These loans are meant to fill in the. The amount varies by year.

Ad Click Now Choose The Best Student Loan Option For You. The academic year is 30 weeks in length and is defined as fall semester 15 weeks spring semester 15 weeks with summer sessions as a trailer. Because they are subsidized there are 6-month grace periods.

This online dashboard allows a utility to compare a low-interest loan through an SRF or USDA program to a commercial loan at the market rate. If a Direct Subsidized Loan has a zero balance that is effective or before July 1 2021 then the Direct Subsidized Loan will not have its subsidy benefits reinstated as it is no. It can only be applied for after the student has applied.

Ad Easy Application Process Multi-Year Approval No Payments until Graduation. What is a subsidized loan. Department of Education pays the interest on a Direct Subsidized Loan while youre in school at least half-time for the first six months after you leave school referred to as a grace.

See why Nelnet Bank is a better choice for private student loans. With a subsidized student loan the US. For undergraduate students who are dependent on their parents you can borrow a total of 31000 in Direct Unsubsidized Loans.

For students enrolled as regular students in eligible programs annual Federal Direct Loan limits are as follows. Department of Education pays the interest on your loan while youre in school at least half-time and for the first six months after you leave school. When President Biden first announced up to 20000 of student loan forgiveness details were sparse.

31000 -- No more than 23000 of this amount may be in subsidized loans. Department of Education subsidizes - pays the interest on - your loan while you are in school. These are loans extended to the parents of the student to help pay for schooling.

Any borrower who earned less than an adjusted gross income of 125000 250000 for married couple filing jointly or head of household in either 2020 or 2021 will be. Federal Student Aid. You can only receive subsidized loans for 150 of your program.

Loan minimum of 1000 maximum up to 100 cost of. Customize Your Student Loan With Rate And Repayment Options. For all subsidized federal student loans the US.

You pay interest on both types of loans but subsidized loans often cost less overall. Graduate or professional students may receive up to. The aggregate loan limit for dependent students is 31000 in combined subsidized and unsubsidized loans.

Direct Subsidized Loans are need-based and dependent on Expected Family Contribution EFC to determine the loan amount. Congress sets the interest rates on all federal student loans. The student who takes up the loan will not have to pay interest of the loan at least half the interest even.

Student Loans Unsubsidized Vs Subsidized 2022

Understanding Student Loan Interest Rates Infographic Via Younginvincibles Com Student Loan Interest Student Loans Loan Interest Rates

2

How And Where To Get Private Student Loans For Bad Credit

How Long Does It Take To Get A Student Loan 2022 School Travel

Consumers Can Handle Fed Tightening Their Debts Delinquencies Foreclosures Collections And Bankruptcies Wolf Street

Biden Cancels 10 000 In Federal Student Loan Debt For Most Borrowers R News

Consumers Can Handle Fed Tightening Their Debts Delinquencies Foreclosures Collections And Bankruptcies Wolf Street

Consumers Can Handle Fed Tightening Their Debts Delinquencies Foreclosures Collections And Bankruptcies Wolf Street

2

/ChooseAmongBronzeSilverGoldAndPlatinumHealthPlans2-d91b2944d5494cd8818e76d01230a608.png)

Choosing Bronze Silver Gold Or Platinum Health Plans

Does Deferring Student Loans Affect Credit Credit Com

2

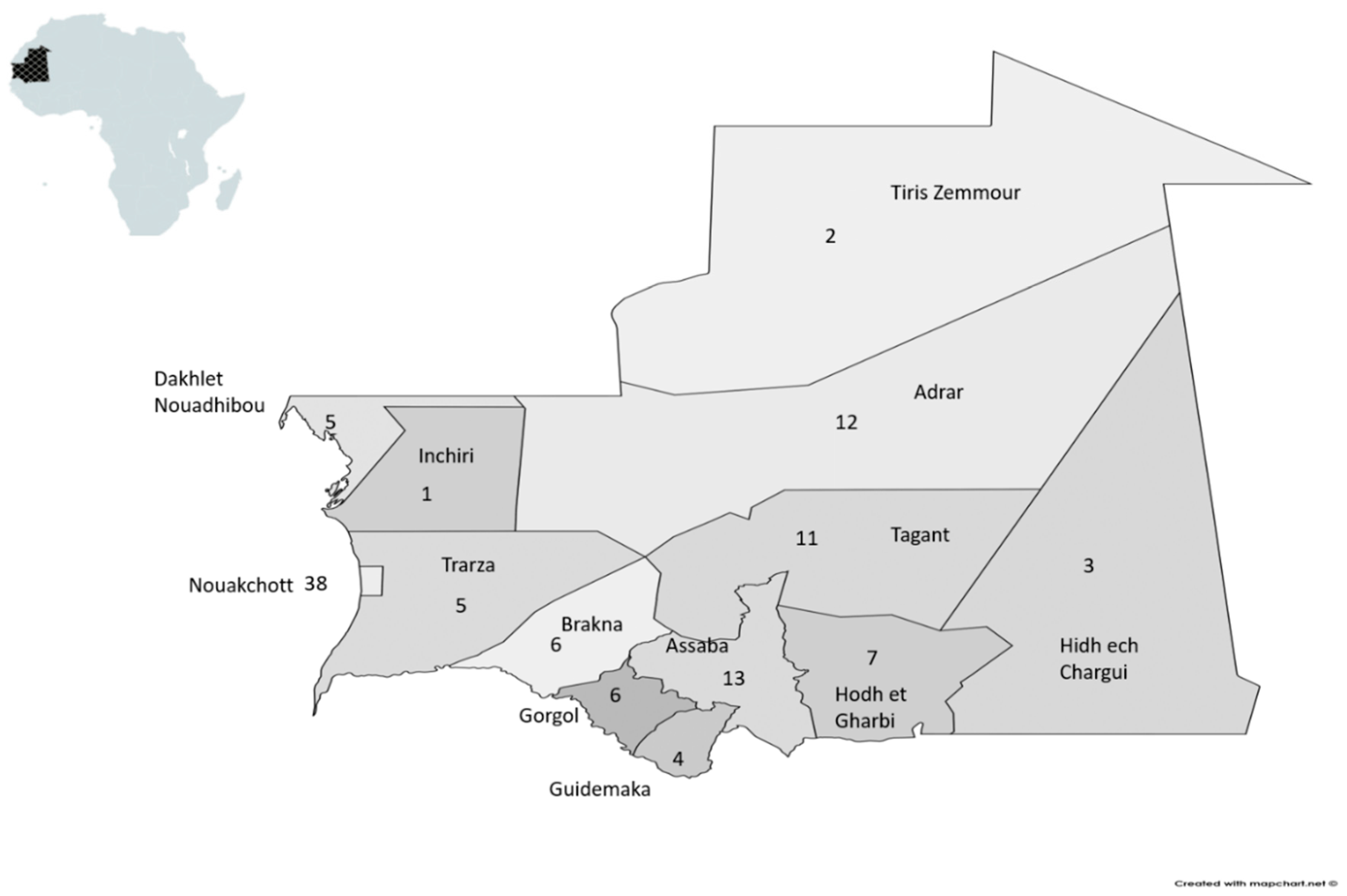

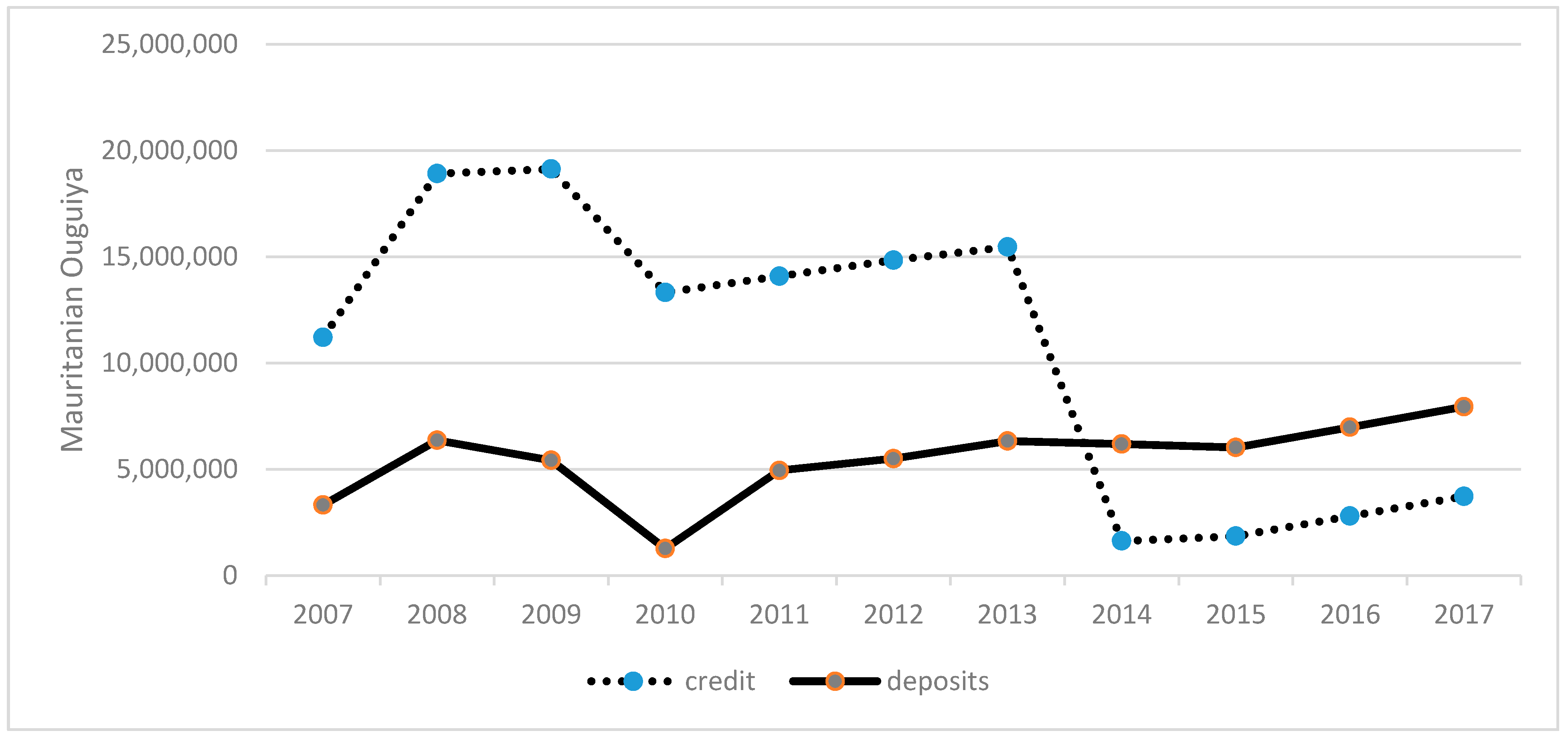

Jrfm Free Full Text Bottlenecks To Financial Development Financial Inclusion And Microfinance A Case Study Of Mauritania Html

Jrfm Free Full Text Bottlenecks To Financial Development Financial Inclusion And Microfinance A Case Study Of Mauritania Html

Blog Ultimate Guide To Federal Student Loans

/college-student-concentrates-while-studying-in-the-student-center-813979970-5b61e76dc9e77c00501e7098.jpg)

Pell Grant Definition